The Middle East hay demand has reached record highs in 2025, driven by rapid expansion in the dairy and livestock sectors across Saudi Arabia, UAE, Qatar, and other Gulf nations. Since domestic cultivation of water-intensive crops like alfalfa has been banned in several countries, reliance on imported alfalfa and oaten hay has become essential.

In this article, we’ll explore the factors driving demand, which countries import the most hay, the difference between alfalfa and oaten hay, and what the future holds for hay imports in the Middle East.

Why Middle East Hay Demand Is Rising in 2025

The Middle East is one of the most water-stressed regions in the world. Countries like Saudi Arabia and the UAE have banned cultivation of certain forage crops, making hay imports a necessity.

Key drivers of rising hay demand include:

- Water Scarcity & Crop Bans

- In 2018, Saudi Arabia banned alfalfa cultivation to preserve groundwater. The UAE has enforced similar restrictions.

- This forced farmers and dairy companies to rely entirely on imports.

- Population Growth & Rising Consumption

- The Middle East’s population is projected to exceed 500 million by 2030.

- Rising consumption of milk, meat, and poultry creates greater feed requirements.

- Dairy Mega-Projects

- Qatar’s Baladna Dairy (home to over 24,000 cows) relies on imported hay to supply more than 95% of the country’s milk.

- Saudi Arabia’s Almarai and Arla Foods also depend on large-scale imports.

- Preference for High-Quality Imported Hay

- Livestock farmers demand hay with consistent protein and fiber levels.

- Imports from the US, Spain, and Australia meet these strict standards.

👉 According to USDA Saudi Arabia imported over 3 million metric tons of alfalfa hay in 2023, making it one of the largest hay importers in the world.

Saudi Arabia & UAE: The Largest Hay Importers

The Kingdom of Saudi Arabia (KSA) leads hay imports in the region. With its cultivation bans in place, the kingdom depends on imports valued at over $1.2 billion annually. Main suppliers include:

- United States – high-protein alfalfa hay

- Spain & Italy – premium sun-dried hay

- Australia – oaten hay, known for digestibility

The United Arab Emirates (UAE) is the second-largest hay importer. Dubai’s Jebel Ali Port is now a major hub for feed imports, supplying farms across the Emirates.

Other key importers include:

Qatar: Relies on imports for Baladna Dairy, which produces over 400,000 liters of milk daily. (Baladna Dairy Kuwait & Oman: Steady but smaller hay importers.

Egypt & Turkey: Produce locally but import premium hay to supplement demand.

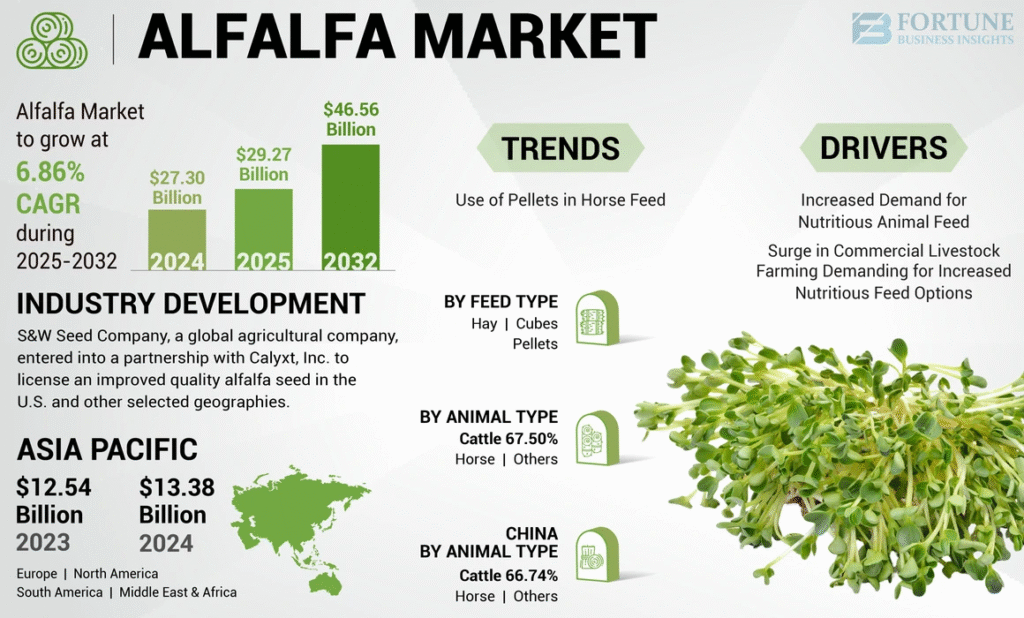

Alfalfa vs Oaten Hay in Middle East Livestock Farming

In the context of Middle East hay demand, two types dominate: alfalfa hay and oaten hay.

- Alfalfa Hay

- Protein-rich (16–20% crude protein).

- Supports higher milk yields and fast weight gain.

- Preferred for dairy cattle and young calves.

- Oaten Hay

- Higher in fiber, lower in protein (9–12%).

- Improves digestion and overall cow health.

- Often mixed with alfalfa for balanced rations.

📌 In 2024, Australian oaten hay exports to the UAE grew by 30%, according to Zawya . Farmers increasingly prefer oaten hay for its consistency and digestibility.

Case Studies: How Hay Imports Power Middle East Farms

- Baladna Dairy (Qatar)

- Imports thousands of tons of alfalfa and oaten hay annually.

- Supplies 95% of Qatar’s dairy products.

- Almarai (Saudi Arabia)

- One of the largest dairy producers in the Middle East.

- Sources premium hay from the US and Spain.

- Masakin Dairy (UAE)

- Reports better milk yields (+2 liters per cow) after switching to Australian oaten hay.

These examples show how consistent hay imports directly improve dairy performance across the region.

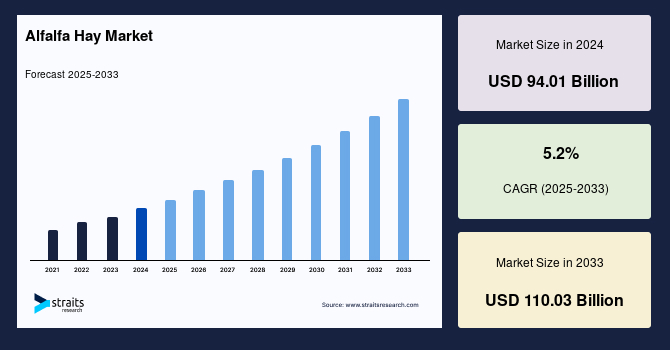

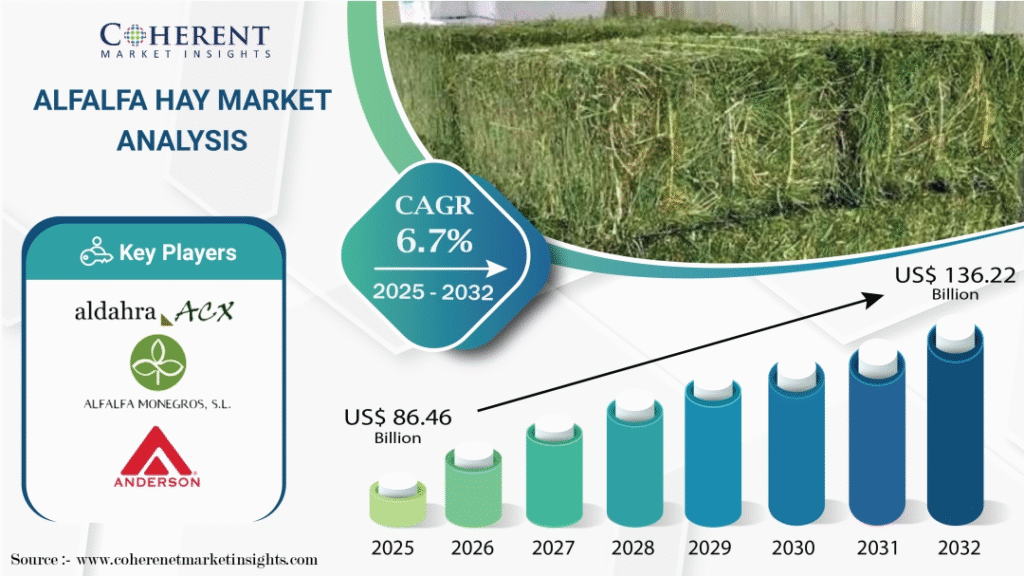

Future Outlook: Hay Demand Through 2030

The Middle East hay demand is projected to grow at 8–12% annually until 2030. Factors shaping the future include:

- Vision 2030 Projects (Saudi Arabia) – Large-scale dairy farms will increase feed requirements.

- Rising Dairy Consumption – Per capita milk consumption is expected to rise 20% across the Gulf by 2030.

- Improved Logistics – Investments in storage & transport (Dubai, Oman) ensure hay quality upon delivery.

- Sustainability Push – Buyers demand eco-certified hay (HACCP, ISO).

👉 According to IndexBox, the Middle East hay equipment market is also set to grow by 15.9% CAGR through 2030, showing increased investment in feed production and logistics.

FAQs About Middle East Hay Demand (2025)

Q1. Why is Middle East hay demand increasing in 2025?

Due to water scarcity, bans on forage cultivation, and booming livestock farms, countries like Saudi Arabia and UAE rely heavily on hay imports.

Q2. Which Middle Eastern countries import the most hay?

Saudi Arabia leads the region, followed by UAE, Qatar, Kuwait, and Oman.

Q3. What types of hay are most in demand?

Alfalfa hay (for protein) and oaten hay (for digestibility) dominate Middle East imports.

Q4. How do exporters maintain hay quality during transport?

Hay is compressed, pelletized, and stored in humidity-controlled containers, ensuring freshness upon arrival at ports like Dubai’s Jebel Ali.

Q5. Will hay demand in the Middle East continue to rise after 2025?

Yes. With population growth, Vision 2030 projects, and limited water resources, imports are expected to rise steadily through 2030.

Final Thoughts

The Middle East hay demand has become one of the fastest-growing agricultural import markets in 2025. With Saudi Arabia and UAE at the forefront, and Qatar and Egypt rapidly expanding, the need for high-quality alfalfa and oaten hay will continue to grow.

For exporters, the region presents significant opportunities. The key to success lies in quality assurance, efficient logistics, and long-term partnerships with Middle Eastern dairy and livestock producers.

🌍 At GlobalHay.com, we help bridge the gap between premium hay suppliers and Middle Eastern buyers, ensuring consistent supply for a thriving livestock sector.